Every so often, I come across an article or comments that bear along the lines of:

“If today’s worker is more productive then the workers of yester-decade, why aren’t we getting further ahead? Shouldn’t we be all working only a couple of days a week instead of the 35-40+ hour standard workweek?”

Besides the fact that globalization has changed the value of what “productive work” is in America (which is another whole discussion altogether that I’d like to visit at some point), the other costs of living – such as housing and health insurance – may actually be the driving force behind where most of our productivity gains have gone.

Housing is pretty easy to explain. Just take a look at the following chart, courtesy of Federal Reserve Bank:

In short, housing has kept up over 500%, since the 1970’s. This easily explains why the “boomers” were seemingly able to purchase a home and fund a number of what appear now to be luxuries with far, far less income.

OK, so housing has gone up – so why have real wages seemingly gone down so rapidly? (i.e. why do most folks feel like they are just ‘treading water?’)

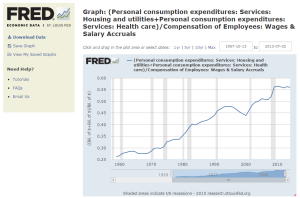

More interestingly – not only has housing increased, but Health Insurance costs may perhaps be the second major component to the problem of “declining wages” Take a look here:

http://research.stlouisfed.org/fred2/graph/?g=XNg

As one can easily see – combining housing + health insurance costs, as a % of total employee compensation (or pay, in short) – steadily increased from 27-30% or so in the early 1970’s – to 56%+ (close to DOUBLE) in the present day.

Understanding the incredible increase in healthcare costs in terms of lost wages may be a bit tricky. Unlike rent or a mortgage payment which is clearly paid by the employee – health care costs, besides being available with a myriad of options and also having a portion of it being covered by the employer – employees may not be as easy to “see” its true costs .

As a basic example, at my company, a plan with “pretty good” family coverage is about $1500/month. This works out to about $18000/year.

With median household income at less than $60000 a year[1], just healthcare alone is 30% of the PRE-TAX budget of an average family!

“But hold-up.. isn’t New York’s living expenses much higher?

Don’t New Yorkers earn alot more than the average US family?

Shouldn’t that increase be also taken into account?”

OK – let’s look at up… Unfortunately, the increase really isn’t much, at $58003 [2] . Working out the math, we’re STILL at over 30% of PRE-TAX dollars being spent on health insurance.

“But wait… it can’t be 30% of my budget. Don’t most employers split or cover a portion of the cost of health insurance?”

Therein lies the issue. Even with productivity increases, the increasing cost of just health insurance alone whittles away at many businesses abilities to increase their employee’s salaries accordingly when average yearly increases were in the realm of 10-11% per year. [3]

Granted, this rate is coming down with ACA / Obamacare being in affect in the past couple of years – but the increases have been happening for a long time. For this article, let’s take a look at the more historical, longer time horizon perspective.

So, let’s do some quick math. Let’s assume that:

– Our NY family earns the average $58000 income, pre-tax

– Health insurance takes up about 30% of a family’s actual compensation package / cost.

– The employer covers about 50% of this cost.

– The average annual increase in health insurance cost is 10%

So.. that works out to an average annual increase in $1800/year for insurance, or about 3.1% of the $58000 salary.

With this increase, whether the company or employee pays for it becomes immaterial. Bottom line – before taking into account inflation, an average family is “losing” ~3% of their income / earning capabilities just because of rising health insurance costs.

Envision this – the company wants to give you a 5-7% raise… but by the time they either cover the 3% increase in cost themselves, or deduct it off your paycheck – you’re only actually getting a paltry 2-4% NET.

—

So, forgetting Globalization for the moment, it’s easy to see how the two prongs of ever rising cost of housing plus exponentially increasing health insurance costs can easily cause the average worker’s income is flat-lining (or decreasing really, in real / inflation-adjusted dollar terms).

Sources:

[1] – http://en.wikipedia.org/wiki/Household_income_in_the_United_States#After_2010

![[Personal Development] Recommended Reading List](http://www.stevenwcheung.com/wp-content/uploads/2014/10/reading_recommendations-672x372.jpg)